In the traditional loan structure, financial institutions like banks act as the mediator. For the borrower, this generally means loans with high interest rates and a delay in loan disbursement.

Table of Contents

However, P2P lending single handedly solves both these pain points. In peer to peer lending, the transaction directly takes place between the borrower and the lender.

As no mediator is involved, no additional costs are associated with procuring the loan. Further, the request to loan disbursement turnaround time is significantly reduced.

The concept of P2P lending is not new. An earlier account of peer-to-peer lending schemes in 18th century France states that local non-notarized credit markets existed way before the banks came around.

These markets typically functioned in closed circles–people living in close neighborhoods exchanged money both in cash and goods (barter system) in the form of deferred payments.

In fact, David Nicholson–the mastermind and co-founder of Zopa–reveals that inspiration for Zopa came from understanding the pre-banking past & the basic principles of lender-borrower relationship.

P2P lending made a comeback with the launch of Zopa in 2005.

Source: Precedence Research

The numbers speak for themselves: the peer-to-peer lending market is estimated to advance at a CAGR of 28.3% during 2021–2031.

Other factors:

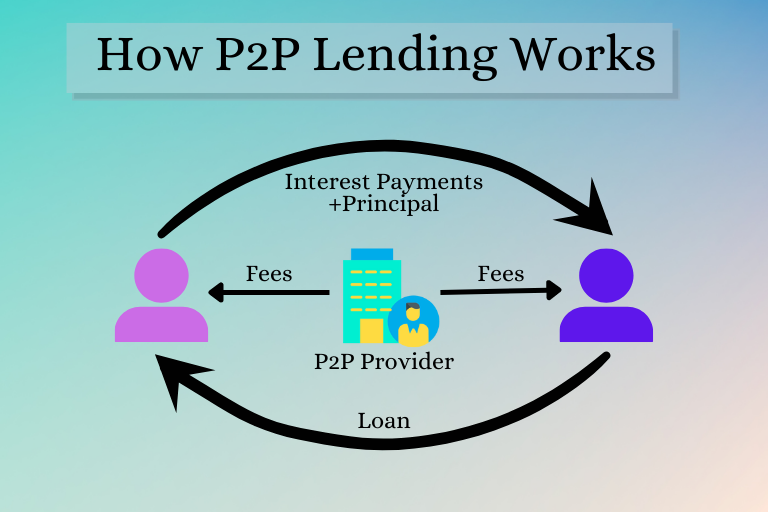

Peer to peer lending is fairly straightforward. All transactions are carried out through a specialized online platform.

Here are the steps:

Take note:

The applicant needs to pay interest payments periodically. Further, they need to repay the principal amount at maturity.

Further, the company maintaining the online platform charges a fee from both borrowers and investors for the provided services.

They can be both private individuals and institutional investors. Besides, traditional credit institutions like banks are increasingly allowed by platforms to participate in the funding.

The reward received by investors in peer-to-peer lending is interest payments. These depend on the borrower’s default risk and the loan term.

They can be both businesses and private individuals. Generally, everyone who fulfills objective criteria like nationality, legal age, etc. can normally invest in P2P loans.

However, borrowers must pass a credit rating system that defines whether it is possible to borrow and on what terms.

Borrowers achieve financing through an open call. So, it is easy for everyone interested to participate.

Globally, the first two models are majorly prevalent. But we will substantiate on the other ones too.

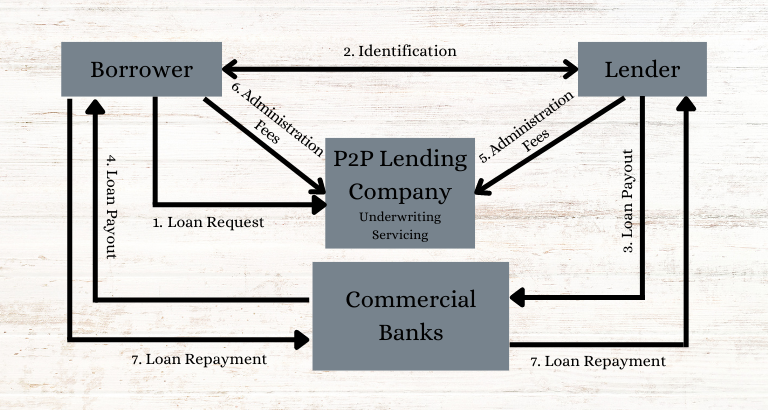

It is the simplest form of P2P lending model where the lenders directly interact with the borrowers and themselves fix their counter parties.

The process is as follows:

Benefits of the Client-Segregated Account Model

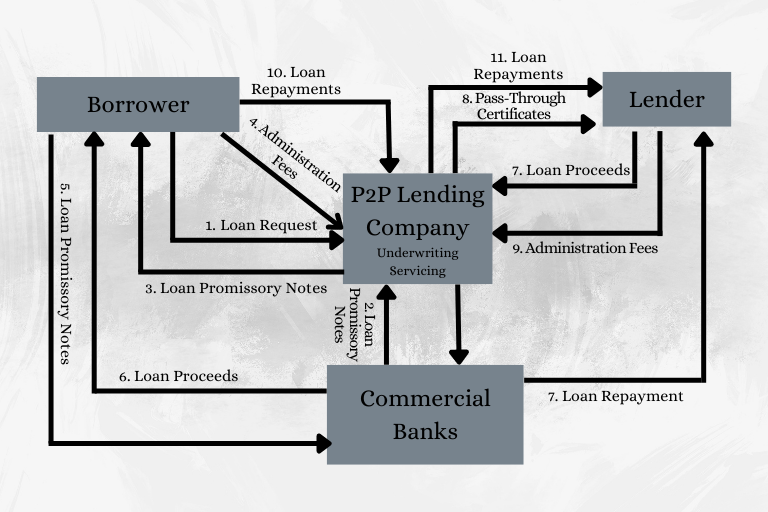

This is a comparatively complex form of P2P lending model. It involves a commercial bank besides the lender or the borrower.

Here’s how the process takes place:

Benefits of the Notary Model:

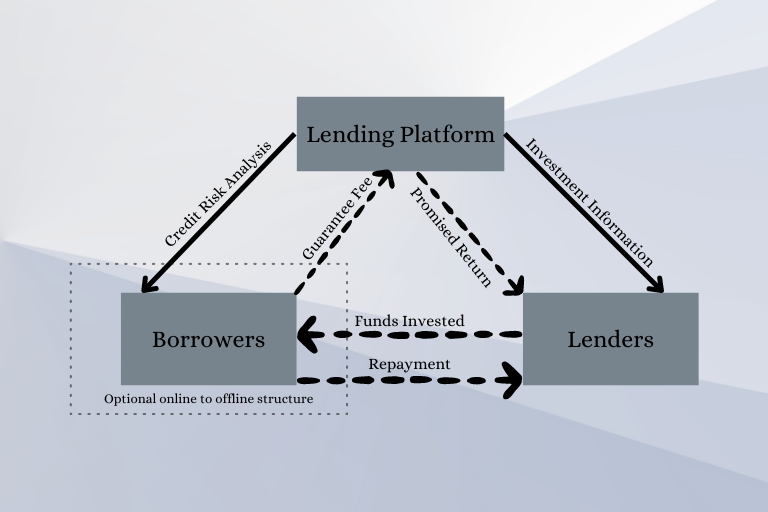

Here, the platform collects funds & applies an interest rate. It is calculated considering the borrower’s risk and the loan’s features.

This can be done using two different methods:

A research and pre-screening of financers outside the platform is done. Then, the loan request is displayed on the platform website for the lenders to make their offers.

This is a popular method in China where there is an excess of supply compared to the demand.

Here, an algorithm automatically invests the funds collected. The remuneration is calculated based on the rates & loan duration.

The platform retains loans in their balance sheet for it to sell them to institutional investors, or other retail investors financing loans.

In this case, the platform obtains the money from these investors and provides it to borrowers.

The borrowers, in turn, pay interests to the lending platform. In case the platform fails, investors will have difficulties obtaining their money back.

There are many reasons to expect the continued rapid growth of P2P lending. The fact that the internet can facilitate disintermediation by allowing parties to communicate directly with one another is a fundamental reason.

Further, P2P lending platforms have several competitive advantages over the incumbent suppliers, i.e. the banks. These are:

Want to build a premium P2P lending marketplace? Talk to us for a free demo.